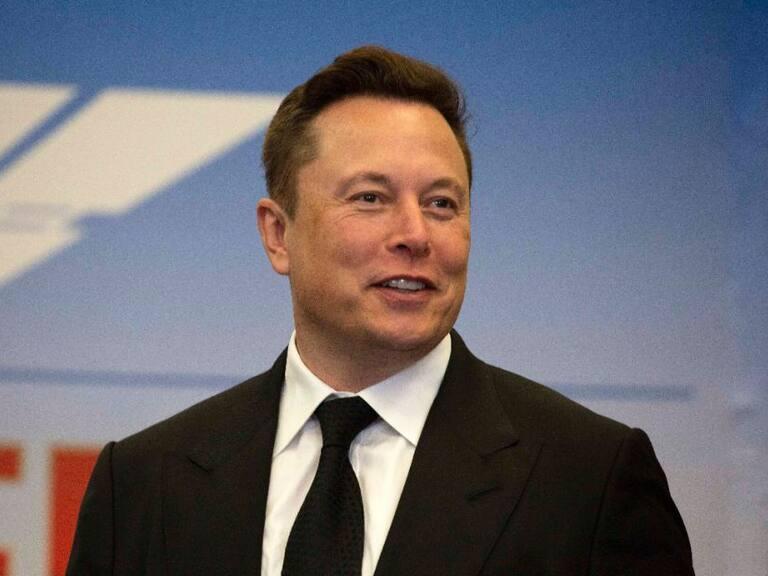

Elon Musk, one of the most influential figures in the global automotive and technology industries, is currently facing a dramatic crisis as recent developments in France threaten to severely impact Tesla and the broader U.S. auto sector. The bold move by French authorities to impose stringent regulations and potential shutdowns has caused Elon Musk’s net worth to plummet by a staggering $138.9 billion, sparking alarm among investors and industry watchers worldwide.

France’s aggressive stance targets Tesla’s operations within the country, citing concerns over environmental standards, labor practices, and competition policies. The French government’s new measures include restrictions on manufacturing, sales, and possibly the outright closure of Tesla’s facilities, a move that could send shockwaves through the U.S. auto industry and global markets. This unprecedented action underscores the growing tensions between national regulatory bodies and multinational corporations, particularly those led by high-profile entrepreneurs like Musk.

Tesla, known for revolutionizing the electric vehicle market, has enjoyed rapid expansion in Europe, with France being a significant market. However, the recent clampdown threatens to derail these ambitions, jeopardizing Tesla’s production targets and market share. The ripple effects could extend beyond Tesla, affecting suppliers, investors, and competitors alike, as the industry braces for potential disruptions and financial instability.

Elon Musk’s personal fortune has taken a massive hit amid this turmoil. The $138.9 billion loss reflects not only declining Tesla stock prices but also diminishing confidence among stakeholders. Despite Musk’s reputation for resilience and innovation, the current situation presents one of the most severe challenges of his career, testing his leadership and strategic acumen.

The ongoing financial bleeding shows no signs of abating, with Tesla’s stock continuing to fluctuate amid uncertainty and market volatility. Analysts warn that if France’s policies set a precedent, other countries might follow suit, potentially leading to a coordinated global regulatory crackdown on Tesla and similar companies. Such developments could fundamentally reshape the automotive landscape and Musk’s role within it.

In response, Musk and Tesla’s executive team are reportedly exploring multiple strategies to mitigate the impact, including legal challenges, negotiations with regulators, and diversification of production facilities. However, the complexity and scale of the situation mean that recovery could be slow and fraught with obstacles.

The automotive industry is at a crossroads, balancing innovation with regulatory compliance and geopolitical pressures. Tesla’s experience highlights the vulnerabilities even the most pioneering companies face when navigating international markets and governance frameworks.

In conclusion, France’s decisive move against Tesla and the resulting $138.9 billion loss in Elon Musk’s wealth mark a pivotal moment in the intersection of business, politics, and technology. How Musk and Tesla respond will not only influence the future of electric vehicles but also set critical precedents for multinational corporations operating in an increasingly complex global environment. Stakeholders worldwide remain on edge as this unfolding saga continues to develop.